PhonePe works hand-in-hand with law enforcement agencies to prevent cyber crime

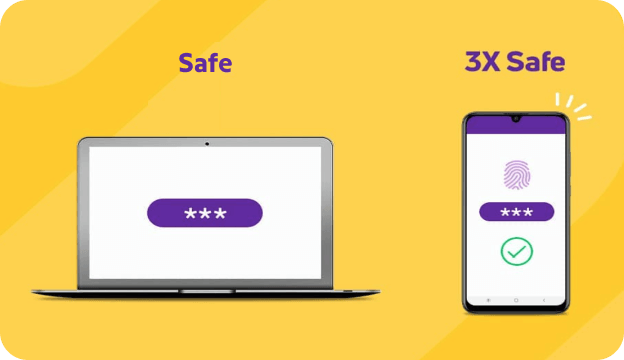

Know MoreThat’s why we have an advanced security infrastructure to keep your transactions safe. We do what it takes to earn the trust that you and 53.5+ crore Indians have placed in us.